One of the questions I receive most often from dealers is whether or not they are overpaying for their third-party classifieds. The dealers overall agree that third-party classified sites (*TPCs) are a foundational element in a successful digital marketing strategy, however they are concerned as the pricing has continued to climb over the years. It seems to be a love/hate relationship.

The TPC space is currently experiencing a significant disruption, as CarGurus is capturing market share from the other two established players, or at the very least applying significant downward price pressure. Cars.com and Autotrader have responded with innovations and changes designed to combat the new CarGurus pressure, but as I advise dealers, let the numbers and results speak for themselves…

Each month, as I sit down with dealers and discuss their results from the big three TPCs, we discuss the many success metrics available. There is of course the reporting available in each of the TPCs’ dealer consoles. However, we also look at Google Analytics referral data, including Multi-Channel Funnel assisted conversions. I help dealers calculate cost per VDP (vehicle detail page), cost per lead, and other important ratios.

…forcing consumers to click through to the VDP for needed details will only frustrate those shoppers in the long run.

One of the most overlooked ratios is the VDP-to-SRP ratio for each of the TPCs. This is the ratio that shows how often a dealer “wins the click” from the SRP (search results page) to the VDP. These ratios vary from month to month throughout the year by dealership, and most importantly by each TPC.

There are many different elements that can affect this for dealers, including effective merchandising, competitive pricing, and scarcity of specific makes and models. By studying the VDP-to-SRP ratio, you can find many interesting data points and come to a number of conclusions. For instance, when dealers downgrade a package with one of the TPCs, receiving less spotlight or featured ads, their VDP-to-SRP ratio will go up, often doubling the prior number. On a side note, while these dealers will see a drop in the raw number of VDPs, the actual number of leads (email, phone, chat) typically only decreases slightly.

My conclusion is that since these featured ads do not follow the consumers search parameters, the shopper simply scrolls past and doesn’t click on the VDP. I know that is my behavior, since I know these listings don’t match my search criteria. That is why I educate dealers to measure ROI performance indices for the TPCs, including cost per VDP and cost per lead to be sure they are spending their limited marketing dollars wisely.

There is also a sharp difference across the board for VDP to SRP ratios for the big three TPCs. Autotrader and Cars.com are typically the same, around 1.5 to 2.0. CarGurus on the other hand is much lower, around 0.5 to 1.0. Opinions may vary, but my conclusion is that their dealer ratings, and “deal ratings” (i.e. good deal, great deal) cause shoppers to be choosier on clicking on VDPs.

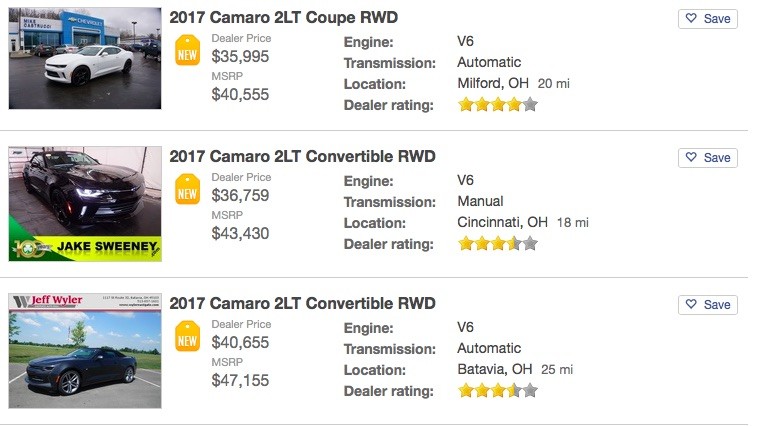

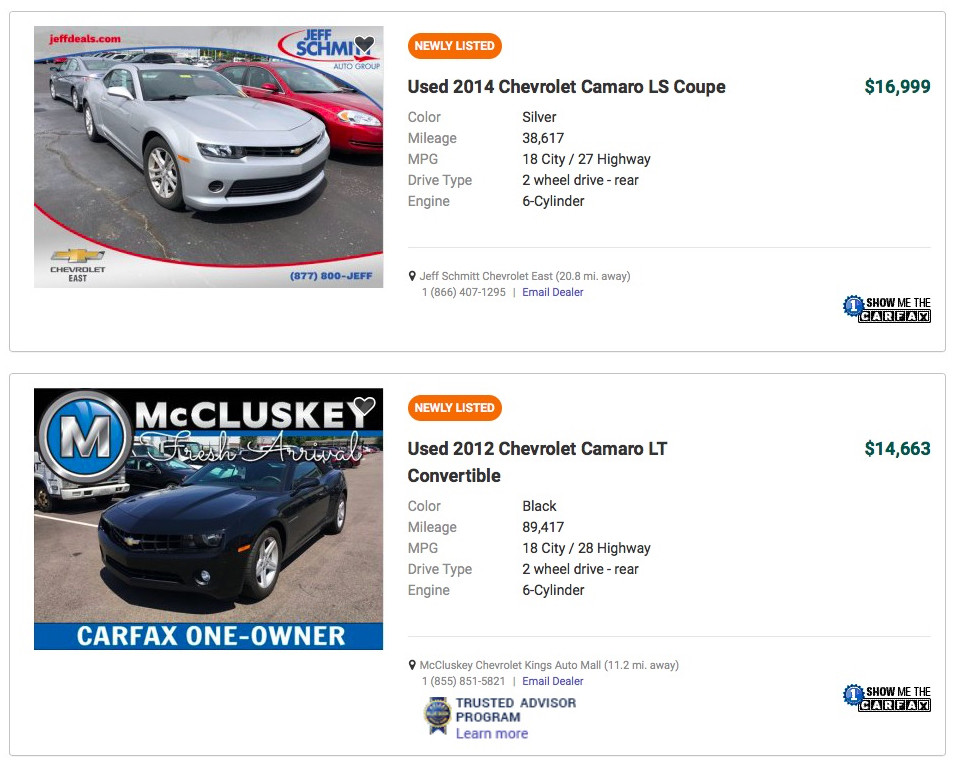

Here is a look at the big 3 TPC SRPs:

CarGurus’ SRP (above) has 15 vehicles per page, and as mentioned contain both dealer ratings and deal ratings. Not a bad SRP, but would be better with indicators on multiple photos, videos, etc.

Autotrader’s SRP (above) has 25 vehicles per page. They recently changed their SRP pages and eliminated many elements in the process. Autotrader removed the ability to list multiple prices (i.e. MRSP, and discounted price). They also removed the indicator of multiple photos, and transmission. I’m not sure if they are trying to drive more VDPs by forcing the consumer to click through, or perhaps trying to speed up the pages. Either way the ATC SRP is my least favorite, from both a consumer and dealer perspective.

Cars.com’s SRP (above) has 50 listings per page, and is by far the most consumer-friendly and dealer-friendly. They display multiple prices, multi-photo indicator, transmission included, as well as a clear call-to-action.

In the end, the TPCs serve two masters, both creating a great shopping experience and driving results for the dealers paying for the listings. Helping dealers get their cars in front of the consumer is only the beginning. I feel the TPCs need to help the dealers “win the click” if their vehicle is a better fit for the shopper. By putting better information on the SRP, they both help the consumer speed up the shopping process and help the dealer deliver the right vehicle to that consumer.

In my opinion, forcing consumers to click through to the VDP for needed details will only frustrate those shoppers in the long run.

What do you think? Comment and Join the conversation over in our dealer forums!