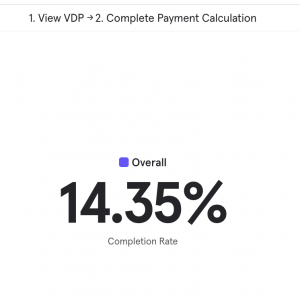

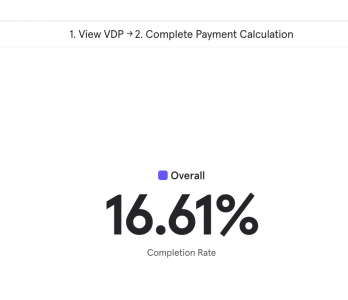

Do you know what your dealership website is saying to customers? If you have a finance calculator you are telling customers the wrong thing! You are creating another channel of friction for your customer.

Only the dumb ones.

Smart customers are going to set a price way lower than you’d like because that’s where they plan to start negotiating.

How many customers set a price with taxes? What about your fees?

Nobody knows how to calculate taxes and fees. What about trade equity? What about rebates?

Where are the leases!!!

This is my biggest peeve with finance calculators. They can’t calculate a lease to offset that big payment the customer just saw on a loan.

And what about used car leases?

As I write this new car supply shortages are abundant and maybe on the cusp of getting worse. We’re missing chips and may soon be missing the metals required to build the cars. This means we are going to be selling more used cars and as market values continue to inflate, people are going to need to lease used cars to afford them.

The legacy finance calculator that came with your website is probably not on any website company’s product roadmap for improvement. They have mostly been the same since the first dealership website payment calculator was launched over 20 years ago. Don’t feel bad about requesting your website company to remove it – I doubt they will find offense.

TLDR: turn off the finance calculator on your website.

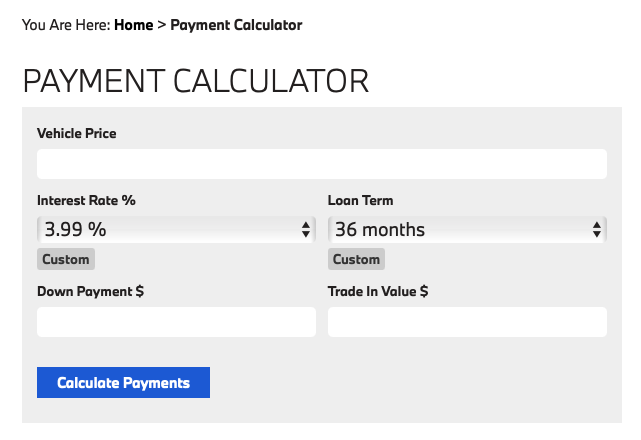

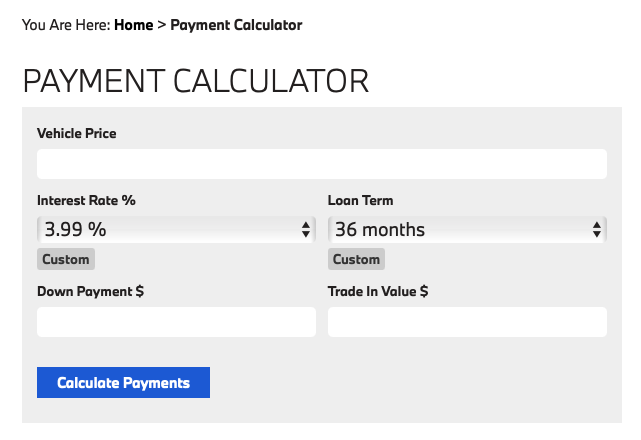

Most finance calculators that come with Dealer.com, DealerOn, Dealer Inspire, Sincro, etc website solutions are free forms that allow the customer to input whatever she wishes.Price

Letting your customers set their own price is dangerous. How many customers actually enter the selling price you have listed?Only the dumb ones.

Smart customers are going to set a price way lower than you’d like because that’s where they plan to start negotiating.

How many customers set a price with taxes? What about your fees?

Nobody knows how to calculate taxes and fees. What about trade equity? What about rebates?

Interest Rate

Do I really need to explain the futility of pushing your customer offsite to their own bank to find their best rate?Loan Term

This is where customers can quickly knock themselves out of the market on your car. Old adages like “never finance for more than 48 months” still exist. Grandpa is still giving advice.Where are the leases!!!

This is my biggest peeve with finance calculators. They can’t calculate a lease to offset that big payment the customer just saw on a loan.

And what about used car leases?

As I write this new car supply shortages are abundant and maybe on the cusp of getting worse. We’re missing chips and may soon be missing the metals required to build the cars. This means we are going to be selling more used cars and as market values continue to inflate, people are going to need to lease used cars to afford them.

Digital Retailing competition

If you have a digital retailing solution, your finance calculator is definitely at odds with the other finance calculator inside your digital retailing solution. One calculator should rule the website! Choose one.The legacy finance calculator that came with your website is probably not on any website company’s product roadmap for improvement. They have mostly been the same since the first dealership website payment calculator was launched over 20 years ago. Don’t feel bad about requesting your website company to remove it – I doubt they will find offense.

————————————————–

Who knew an argument with Jeff Kershner, in 2005, would lead to Alex becoming a partner with him on DealerRefresh. Where will the next argument take ...

Current Discussion Topics