You may have seen some comments from me on the message boards, but for anyone interested in who I am (Nick Hummer) and why I wrote this (short answer: because Jeff asked).

I’m currently the Director of Advertising Solutions at Cars.com, working on my 9th year in the company. Assuming Jeff invites me back, you can expect to hear from me on a regular basis about what we’re seeing in terms of car shopping activity on Cars.com, how dealers can get more value out of their investments in our products, and the number one thing Jeff asked me to cover: ways you can help make Cars.com better.

This week, Cars.com is launching the new-car features we’ve been hinting at for a few months now. If you’re asking yourself why that is, I can provide all sorts of answers, ranging from the rebounding of new vehicle sales to growing new-car shopping activity online and addressing the opportunity that presents us as a third-party automotive shopping site, particularly given the opportunity to take advantage of high shopper perception of Cars.com as a new-car site (we also desperately need a distraction from D-Rose’s injury here in Chicago).

Far more important is this: consumers who are considering purchasing a new vehicle want different tools than those available for used-car shopping. Yes, a car is a car is a car, but dealers know better than anyone that people shopping for a new vehicle have different needs and in many cases demonstrate different shopping behavior than people shopping pre-owned.

The great news for dealers is that one of the biggest needs is guidance in choosing not just the right vehicle, but also the right dealer. Put simply, used-car shoppers want a car that meets their ideal model-year/price/mileage/vehicle history criteria (making the list of where they can buy it fairly short). We’ve found that new-car shoppers also want a car offered at a competitive price, but they’re much more likely to want to buy it from a dealer they can trust to take care of them throughout the life of the vehicle – and beyond, if things go well.

Notice I said competitive price, not lowest. According to an awesome DriverSide/Kelton research study from April 2011, 91% of new-car shoppers want to read your service reviews prior to purchasing a vehicle, representing one of many insights challenging the notion that price is the only thing that matters.

Today, the majority of our franchise dealer customers have been transitioned over to BaseDrive, our new package designed to help them tell consumers why they should choose their store over their competitors’. I don’t want to get too deep into “selling” here – that’s not why Jeff asked me to be a contributor on DealerRefresh, but I would urge franchise dealers to get to know the new features, as there are some areas where input from the dealer can impact their performance (I get into some tips below).

Your sales rep will walk you through the new features, and you can also access more information here. The overall idea is that offering dealers the ability to better market their brand on our site makes for more educated consumers and, ultimately, more qualified traffic to your store – everyone wins. To this end, we’ll be rolling out a brand new Market Intelligence Report next month, providing market-specific insight into the new car space based on Cars.com traffic data.

Now, onto the things you can do to impact the performance of your new ad package, as well as some tips for better online brand differentiation overall:

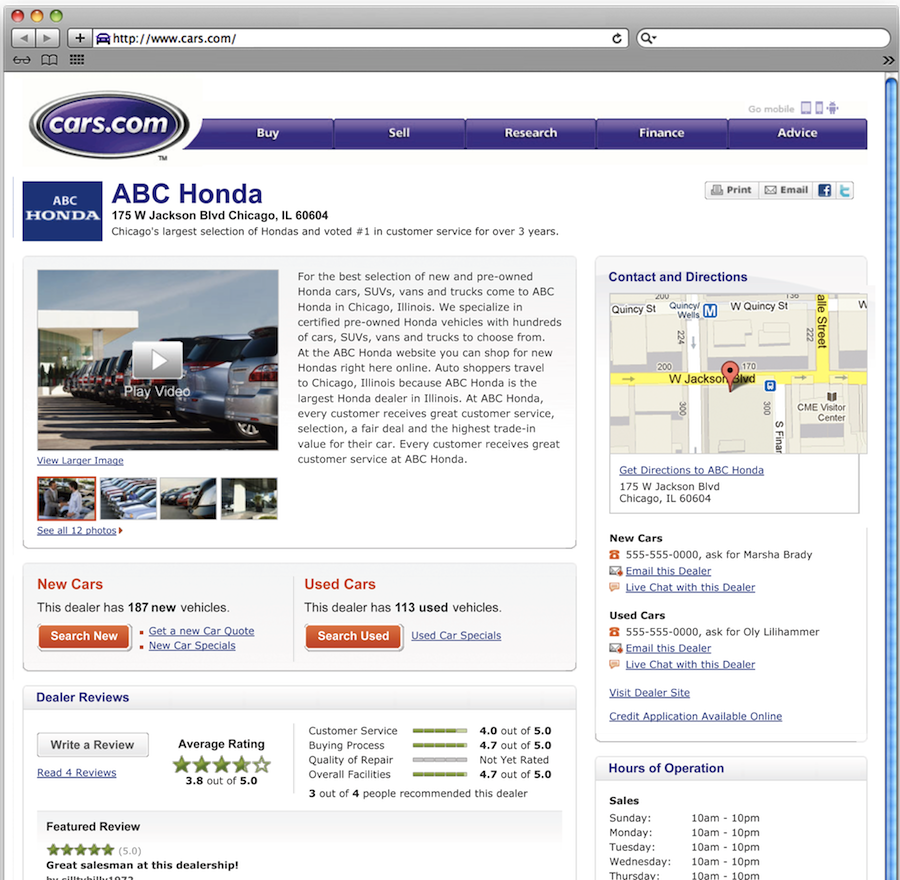

1. Reviews – Come on, you knew this had to be on here. With reviews, the only one metric I really stress is volume across the sites your shoppers frequent. With the changes we rolled out this week, your Dealer Reviews play a much more prominent role in differentiating your store with our audience, but I recommend building volume on all the reviews sites in your market that get traffic from people shopping for a car.

More is always better, but our research indicates you want at least 8 on each site. After volume, focus on conversion. There’s been some discussion in our industry about page views as an important metric, and my response to that is that reviews exist to build confidence and drive more business to the retailers whose previous customers have good things to say – tracking conversion is simply a better gauge of how reviews impact your bottom line.

2. Fill out your Dealer Profile Page – and while you’re at it, claim and fill out all the places your dealership information is listed online, from Yelp and Google Places to yellowpages.com. Most of you probably have Yelp and Google covered, but doing a quick check at getlisted.org can tip you off to the more obscure directory sites. When you input your hours of operation, don’t forget service – consumers want to know that taking their car in for service down the line will be convenient for them. On your Cars.com profile page specifically, you can add a tagline and a short description of your dealership, and consider adding a video highlighting the reasons to shop at your store.

3. Let us hear about it – the good and the bad. We’ve spent the last 18 months talking to dozens of dealers: running prototypes in pilot markets, conducting focus groups and seeking out as much advice as we can get. We’ve got a lot more to come, both for consumers and dealers, and the more feedback we hear from you, the better our site and our opportunities for dealers to get in front of online new-car shoppers will be. Let us know what works, and maybe more importantly, what doesn’t work. Heck, let me know directly ([email protected]) or talk to Dave Gilmartin, our Director of New Car Strategy ([email protected]).

Thanks for reading, and I look forward to hearing your feedback.