Black Book Online offers Dealerships the “Super Lead”

With the announcement of the new Credit Activator, Black Book Online is offering dealerships a “Super Lead“. Most DealerRefreshers are very familiar, if not already a user of Black Book Online trade appraisal service. We’ve had many discussions around trade appraisal tools for dealership websites here on DealerRefresh but this new service is quiet different from the usual Black Book Online offering.

I sat down with Mike McFall, President of Black Book Online, for a quick Q&A about the new service.

Follow the jump for the Q&A

Jeff – What exactly is this Credit Activator Service?

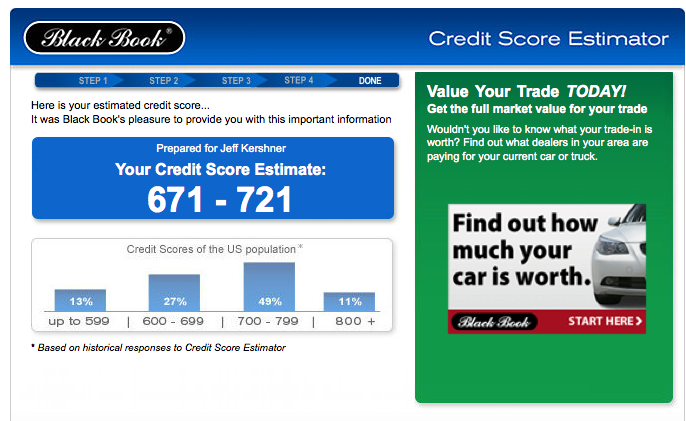

Mike – Credit Activator is a new service offered by Black Book as part of the Activator Complete package. It offers online shoppers a realistic estimate of their credit score so they’re better prepared to meet with a dealer, and in turn, the dealer receives a promising sales lead. The process takes about 3 minutes to complete and doesn’t require sensitive personal information or a credit bureau inquiry.

Jeff – What made you decide to offer a service like this?

Mike – We determined that there was a need. In testing on other product concepts and in formal research, a recurring theme from customers is the need for access to information about credit. Car shoppers want to know where they stand before visiting the dealer. But to get a bureau based score, they must either pay a fee or be willing to submit personal information like date of birth and SSN. We developed a better way.

Jeff – How does Credit Activator it work?

Mike – Unlike a formal credit application, the Credit Activator process asks customers to complete a few short answer questions. In return, they get an instant credit score estimate that allows them to shop with more confidence. You can go to www.blackbookcreditscore.com and experience the process yourself.

Jeff – Why is this concept unique?

Mike – We are creating a Super Lead for dealers. Connecting a credit score estimate to a lead service is the first step – the second is offering a connection with the trade appraisal. Customers will have the option to get both the appraisal and credit score estimate on the dealer website. These customers become “Super Leads” because they’ve indicated their purchase intent and a large portion of the buying process has already been done online.

Jeff – What exactly is a “Super Lead”?

Mike – Most leads offer very little information to the dealer, usually just customer name, vehicle preference and contact information. A Super Lead is different because it includes information about the customer trade-in vehicle and the customer credit score. The more a Dealer knows about the customer the easier it is to arrange a visit and sell a car.

Jeff – Do customers really want a credit score estimate?

Mike – Yes. A recent study conducted by Harris Interactive indicates that 91% of car shoppers would select a dealer who offered more transparency in lending options. More than 12 months of testing with 18 pilot dealers confirms this finding.

Jeff – How was the credit score process created?

Mike – Our own internal experts, drawn from banks like Wachovia, created this patent pending scoring engine which is tuned especially for auto lending. Black Book is known for the best used car values, which are also used by lenders. So, it’s natural that we would expand our services in to the credit area.

Jeff – How do automotive manufacturers and dealers benefit?

Mike – The results from our pilot program show that when placed on a dealer website, the Credit Activator product can double the lead volume compared to having the trade-in service only.

Jeff – Will lenders use the score estimate to grant credit?

Mike – No, the score estimate is not intended to replace the normal credit review process at the dealership. But, dealers report that it can help reduce the amount of time customers must spend buying a car.

Jeff – How does Credit Activator compare to other similar services like FICO?

Mike – Credit Activator is a truly unique, patent pending service. It provides a credit score range estimate based on questions relating to a user’s finances. Users are not required to supply a credit card, date of birth or Social Security Number and are not required to sign up for a monthly service. And the entire process takes less than three minutes for the average user to complete.

Jeff – Why would dealers want to offer this new service?

Mike – This new service works for all dealers who have websites and who want to sell more cars. Dealers can expect to increase their website lead volume by including the new service. Our pilot program reflects this.

Mike, thanks for taking a few minutes out of your busy day to answer a few questions for the DR community. It was a real pleasure. I’ll be looking into the Credit Activator service myself for my dealerships.

If anyone has additional questions, use the comment section below and ask away!